UAE Wills for Expats: What You Need to Know

✅ Quick Summary – Wills for Expats in UAE

-

- Without a Will, inheritance cases can become lengthy, costly, and complicated.

- Muslims vs. Non-Muslims: Sharia applies to Muslims, while non-Muslims can benefit from the UAE Personal Status Law.

- Dubai Court, DIFC, and ADJD – each authority has its own rules, processes, and benefits.

- Bank accounts freeze immediately upon death until liabilities are cleared and inheritance is settled.

- Guardianship of minor children is decided by UAE courts if not specified in a Will.

Why Should Expats Draft a Will in the UAE?

We all know that the UAE has become a key location over the past few decades. And almost all those who have been to the UAE at least once invest. Some buy property, others open bank accounts, their own companies, or decide to move with their families. At the same time, the UAE legislation is quite loyal and transparent.

However, most people who invest now, sooner or later, will face inheritance. That’s why Wills for Expats in the UAE are essential to protect your assets and ensure smooth inheritance.

Wills for Muslims in the UAE

Since the UAE is governed by Sharia law, if a Muslim person dies, the local UAE courts will distribute the deceased’s property and appoint guardians in accordance with the principles of Shariah. Muslim individuals are allowed to register a Will at the Personal Status Court; however, such Wills must fully comply with Sharia principles.

Wills for Non-Muslim Expats in the UAE

Fortunately, the UAE has introduced the Personal Status Law for Non-Muslims. It means that the Sharia Law will not apply automatically. This makes Wills for Expats a vital step for non-Muslim residents to avoid lengthy court processes. However, if a non-Muslim individual dies and does not leave behind a will, the deceased’s relatives should appoint a lawyer and open an inheritance case in the local court.

- A probate case in practice lasts 6 to 8 months, but it can take up to a year.

- It should also be noted that it will be necessary to pay separately for government fees and for legalisation, translation of the package of documents for the court.

- If there are minor children among the heirs, it is even more difficult due to guardianship rules. Additionally, all personal assets of the deceased, including bank accounts, will be frozen until all liabilities are paid.

- That’s why the inheritance case will be a costly and time-consuming process for non-Muslims. In this regard, the expats should sit down and consider protecting their assets in the UAE.

How to Draft the Wills for Expats in the UAE?

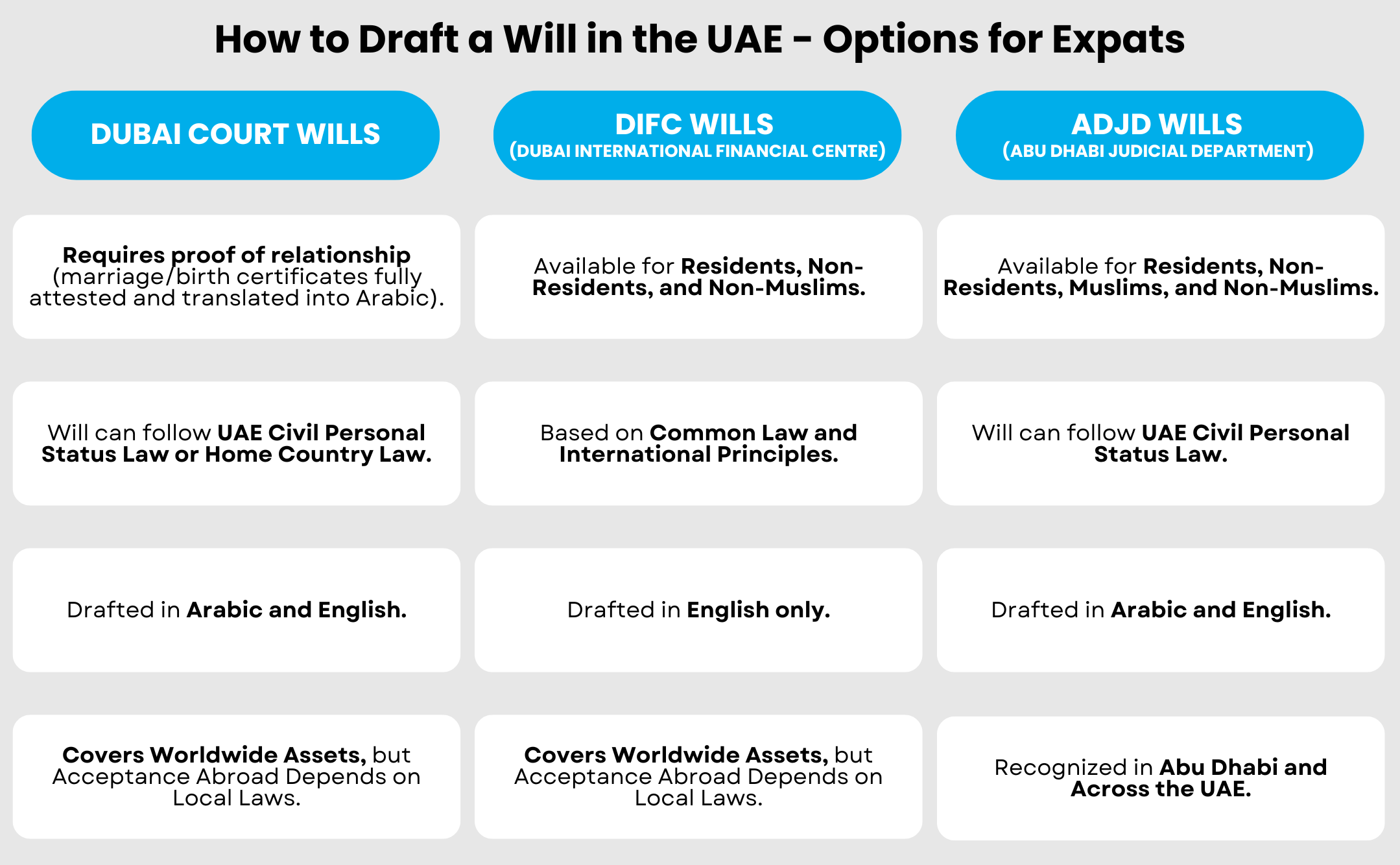

When exploring options for Wills for Expats, it’s important to choose the authority that best suits your circumstances. There are three ways to draft and online register a will in the UAE, and each has its specifics.

- Dubai Court Will– for residents, non-Muslims.

- DIFC Will (Dubai International Financial Centre) – for residents, non-residents, and non-Muslims.

- ADJD Will (Abu Dhabi Judicial Department) – for residents, non-residents,and non-Muslims and Muslims.

🔗 For a more detailed overview, you can also check our Guide to Wills in the UAE.

Each authority operates under its laws, particular process, and participants, and it is important to choose the one that suits your circumstances.

- The difference between the Dubai Court and ADJD Will is that you can apply your home country law or the UAE Personal Status Law for Non-Muslims, and the Will will be drafted in English and Arabic.

- The Dubai Court Will, in most cases, obliges to provide proof of relationship, which means that one needs to provide fully attested and translated into Arabic marriage and birth certificates.

- Unlike the above-mentioned authorities, the DIFC applies Common Law, the Will is drafted in English only, requires 2 Witnesses during the hearing, and can cover the worldwide assets.

- At the same time, it is important to realise that other countries may not accept the registered Will in the UAE when it comes to the distribution of property that is located in that country.

- In this regard, we can add the worldwide assets to the DIFC Will according to Common Law, but it is advisable to consult a lawyer in that country for your assets outside the UAE.

Execution of Wills in the UAE

- Dubai Court Wills: Require opening an inheritance case, but speed up the process (3–6 months).

- DIFC & ADJD Wills: Avoid probate cases; inheritance is re-registered without lengthy court proceedings.

For step-by-step details, see our guide on Wills Drafting in Dubai & Abu Dhabi.

The relatives of the deceased will apply to the court through which the deceased made the will. The deceased’s relatives should appoint a legal representative or lawyer and open an inheritance case to get the Succession Certificate, the Court’s distribution order to execute the Dubai Court’s Will. The Will registered in Dubai Court will help to speed up the process by a few months, and overall, the case will take 3 – 6 months.

Need help applying for a Succession Certificate in the UAE? Chat with us now on WhatsApp and our team will guide you through the process step by step.

Despite this, once a will is drafted through the DIFC or ADJD, no probate case will be opened. There is a process to re-register the inheritance, but it will not be necessary to open an inheritance case and appoint a lawyer.

Since Muslims are restricted in making Wills freely, there are alternative solutions, such as the ADGM or DIFC Foundation can be used for inheritance planning, allowing them to pass their wealth from generation to generation in a more structured way.

👉 Read About Wills in the UAE: FAQ on Assets, Guardianship, and Legal Advice

Need Help Drafting Your Will?

Do you have any questions? We specialize in drafting Wills for Expats in the UAE and can guide you through the entire process. From consultation and drafting, to appointing an online hearing and successfully registering your Will, we’ll be with you every step of the way.

Get in touch now:

📩 sevara@poa.ae | ☎️ +971 56 329 3584 | Explore Our Will Drafting Services

Disclaimer: The content on this page is for general information purposes only and does not constitute as legal advice nor should it be used as a basis for any specific action or decision. Nothing on this page or website is to be considered as rendering of legal advice or legal services for any specific matter. Users of this website are advised to seek specific legal advice by contacting a lawyer regarding any specific legal issues.