Whom You Can Gift Your Property To In Dubai?

Technically speaking, you can gift your property to whoever you wish, whether the beneficiary is your relative or not. However, officially, not all property gift transfers are considered property gifting in the eyes of regulatory authorities, such as the Dubai Land Department (DLD).

One of the main reasons is that the gift transfer carries a significantly lower transfer fee paid to the Dubai Land Department compared to the sale-purchase transfer. For instance, the official transfer fee for a gift transfer is 0.125%, whereas for a sale-and-purchase transfer, it is 4%, determined based on the property’s current value.

Due to such a significant difference in transfer fees, many home sellers often consider selling their properties and registering them as a “gift”. However, this is not an option due to the restrictions imposed by the DLD regarding which cases the reduced gift transfer fee can be applied to.

“Learn how to gift a property in Dubai, read the full guide: Guide To Gifting A Property In Dubai.”

Gift Your Property in Dubai: Quick Summary

- Dubai Property Gifting is restricted only between spouse, parents, kids (1st degree relatives) and the company

- DLD Transfer fee for Gifting Property is 0.125 % from the current market price

- The developer can refuse to issue an NOC in some cases, which can cause delays in the Gifting Transfer

- A Property linked to a Golden Visa in Gifting cannot be gifted

- You can issue a Power of Attorney for Dubai Property Gifting online

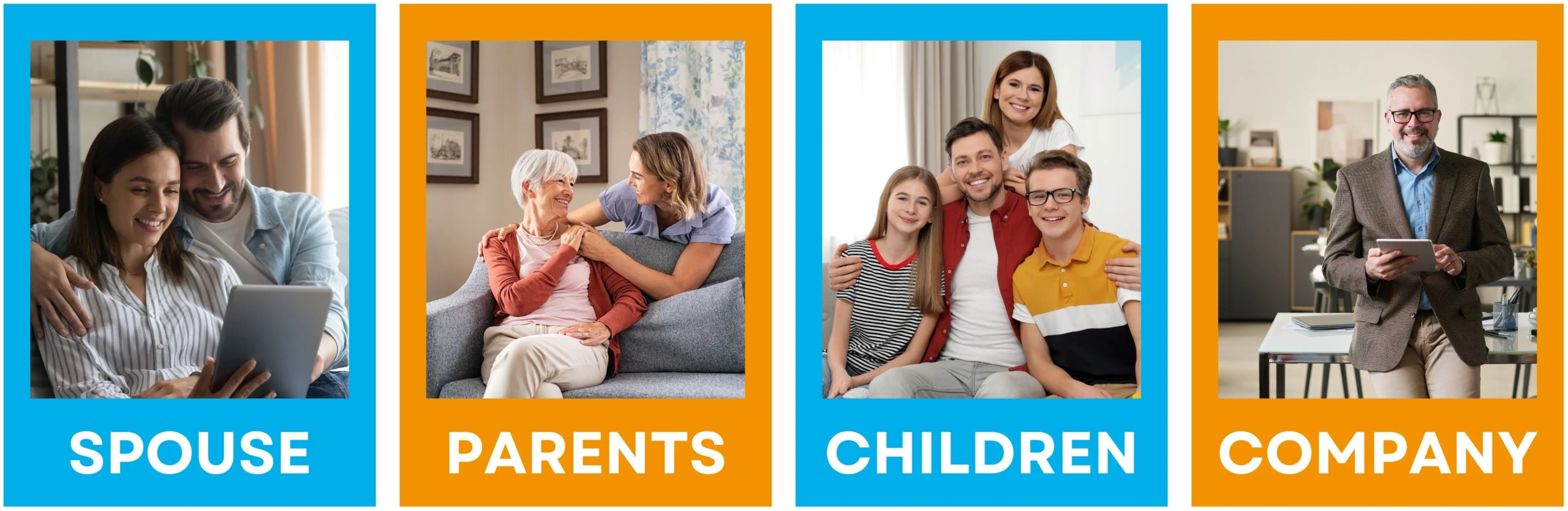

Who Can Receive a Gifted Property in Dubai?

As per DLD rules, gift transfer between the following parties is officially considered as property gifting and can qualify for the reduced transfer fee:

- Spouse (husband and wife);

- Parents and children;

- Company (i.e. if the property is owned by a company and transferred to the company’s owner(s) or vice versa).

To prove the relationship, you will be required to provide proof of the relationship (e.g., a birth certificate, a marriage certificate, or company documents). If the documents are issued outside the UAE, then they need to be attested by the UAE Embassy in the country of origin, then by the UAE’s Ministry of Foreign Affairs, and officially translated into Arabic.

Learn how to gift a property from a company to an owner in Dubai. Read the full guide: Gifting Property From Company to Individual in Dubai.

Non-Objection Certificate from Developer in the Gifting Transactions

A Non-Objection Certificate (NOC) from the Developer is one of the most important documents that must be obtained and provided to the Trustee’s office and the DLD during the transfer.

In most of the cases, the developer issues NOC without any delays once the payment for it is made. There can be several reasons why these delays can be caused:

- Service charges are not fully paid, and the Developer requires the completion of payment for these service charges.

- Property is owned jointly, and another partner is not giving consent for this NOC issuance

- The property owner has made reconstructions without the consent of the developer, who has changed the property, Etc.

Therefore, before starting the process, please make sure that you will not have any issues with the developer in receiving the NOC.

The property that you want to gift shall not be linked to any Golden Visa.

If your property is linked to an Investor Golden Visa, it cannot be gifted or sold. A Golden Visa restricts the property, so DLD will not process any transfer.

To proceed with gifting, you must cancel the Golden Visa and any dependent visas before visiting DLD. Otherwise, the transfer will not be processed, and the gifting may be delayed.

May I issue an online POA for Property Gifting Purposes?

- Dubai Property Gifting Transfer can be completed by means of a Power of Attorney.

- This creates for property owners great flexibility and spare time without getting involved in paperwork and visiting different authorities.

- Therefore, issuing a Power of Attorney will be the starting point of the process itself.

- Good News that Dubai offers a unique opportunity to issue a POA online from anywhere in the world.

- So, if you are outside of the country, or inside of the country, but you have a very limited time that you would like to save, then you can issue a POA online that you can use directly in Dubai.

- This opportunity is open both for UAE residents and for non-residents, no matter where they are physically located at the time of issuing the POA.

- Thus, the entire process from start to finish can be processed online.

Learn why you need a POA for gifting property in Dubai. Read: Why You Need a Power of Attorney (POA) for Gifting Property in Dubai.

Start your online POA now at POA.ae and get step-by-step guidance for a smooth gifting transfer.

FAQs:

1. I own a property under my personal name, and I have a company. I want to gift it to my company and register it under my company’s name. Can I process this gift transfer?

Yes, provided the company documents prove the existence of the company and prove that the company belongs to you, you can process this gifting transaction.

2. I want to gift one of my properties to my son. Both of us are outside of the UAE, and he is not 21 years old. Can we process the gifting of this property still?

Yes, you can issue an online POA on your behalf to gift a property and on behalf of your minor to receive a property and assign a representative to complete the transfer on your behalf and on behalf of your son.

3. I want to gift my shares to my mom. But, my wife, who is a joint owner of the property, is not giving consent to the Developer to issue an NOC. Can we process a gifting without this NOC?

One of the requirements for completing the gifting transfer is to provide an NOC from the developer. Without this NOC, gifting cannot be completed.

4. I have a property, and I have a golden visa based on this property, and I sponsor my wife and kids under my golden visa. May I gift my property?

Once you cancel your visa and all dependent visas to your golden visa, you can process a gifting transfer.

5. My elderly parents own a property in the UAE, and they want to give a POA to me for gifting the property to myself. Can we process the POA online for this?

Yes, a POA for Property Gifting can be issued online.

Disclaimer: poa.ae is a registered trademark and an online portal. It is NOT a notary office or a law firm. Any reference to potential legal services or notary services is outsourced to lawyers, law firms, or notaries licensed to practice in an appropriate jurisdiction. Your access to the website and use of our services is subject to our Terms and Conditions, Cookie Policy, nd Privacy Policy.